The Golden Age of Hollywood between 1910 and the 1960’s was a period of great growth, experimentation and change in the industry that brought international prestige to Hollywood and it’s stars.

Under the all-controlling studio system of the era, five movie studios known as the “Big Five” dominated: Warner Brothers, RKO, Fox, MGM and Paramount. Smaller studios included Columbia, Universal and United Artists.

These studios focused on quality content and were known as ‘dream factories’ hashing out iconic and memorable content which made them powerful and rich. Surely the founders of these studios would be pleased to see their legacies thriving today. However it could be argued that the heart and soul of their legacies has pivoted from a focus on entertaining consumers to pleasing wall street, shareholders and investors.

The corporate first approach has seen these modern studios take on excessive amounts of debt and risk which make them teeter on the brink of disaster.

Case in point, less than six months after AT&T had wrapped up its $85 billion acquisition of Warner Media, then CEO of AT&T Randall Stephenson felt compelled to address the elephant in the room about the acquisition:

“if you hear nothing else this afternoon, I want you to hear me on this, our discretionary cash flow is going to go to one place. It’s going to be paying down debt.”

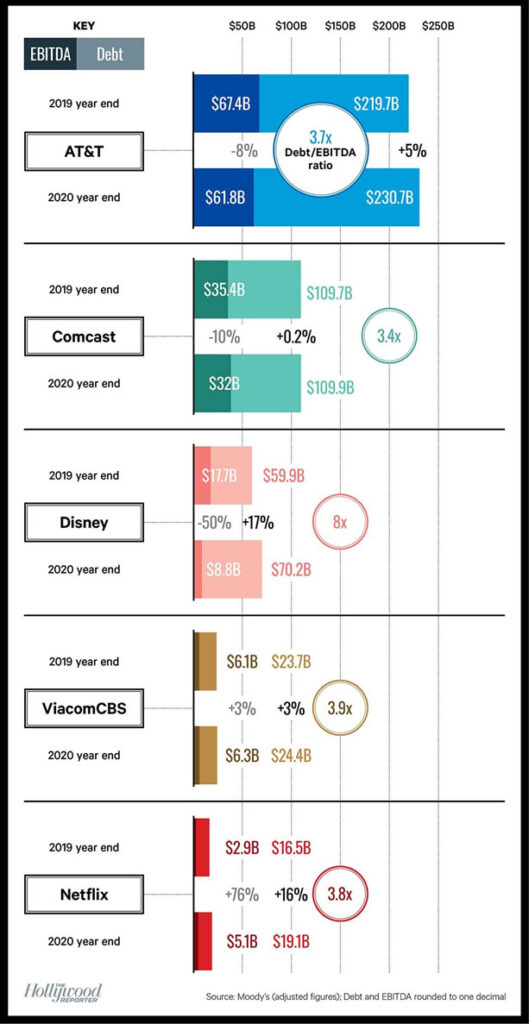

AT&T is not alone in seeing red-ink levels rise in an era of merger mania.

Comcast will have to shoulder $114 billion in debt, according to Moody’s.

The task facing AT&T, Disney and Comcast is a daunting one, requiring deft corporate maneuvering to avert disaster. All three companies have made big bets that the only way to survive and thrive amid the digital disruption to get bigger, and they’ve used debt, lots of it, to finance their empire building.

“if there’s an economic slowdown or interest rates continue to rise, I’m not sure these companies will look back and think that it was such as good idea to pile on debt,” says Hal Vogel, CEO of Vogel Capital Management.

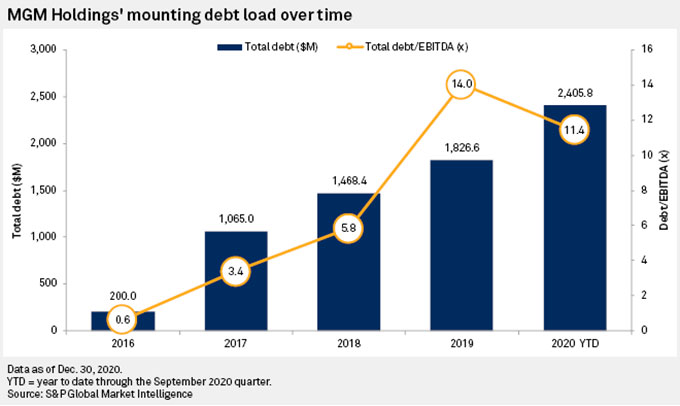

Take MGM for example, the studio behind James Bond and Rocky Franchise who has publicly announced their sale of their studio with a price tag of $5.5bn.

MGM is hopeful the current process will generate interest beyond Hollywood’s traditional players, from international media companies, private-equity investors and blank-check companies, one of the people familiar with the matter said.

MGM’s biggest shareholder, New York hedge fund Anchorage Capital Group, has come under pressure in recent years from weak performance and defecting clients, and its illiquid investment in MGM has become a larger percentage of its hedge fund as it shrinks.

MGM’s exploration of a possible sale comes amid a bidding war for content to fill a new wave of streaming-video services. MGM’s library of titles could make it an attractive target with more than 4000 titles.

MGM is not alone though.

Sure MGM has come out to publicly announce its interest for a sale, but the other major studios are facing daunting tasks to restructure and pay off their excessive debts and shutter an uncertain future.

All of the Hollywood Studios are owned by major conglomerates who subsequently are taking riskier decisions to keep their entertainment subsidiaries afloat.

Unfortunately, the reality of the COVID-19 pandemic has caused an entirely new problem for these media giants who rely on a steady flow of releasing content. With a backlog in releasing heavily anticipated movies and a delay in filming future productions, many studios have been struggling to avoid lagging behind and staying relevant, but especially scramble to staying afloat.

With the future of content consumption still undergoing the biggest shift since the advent of sound in motion pictures in the 1920’s the future remains uncertain for many Hollywood Studios who could be forced by their conglomerates to cut their losses and risks.

Many Studios could be forced to seek an acquisition before facing an ungraceful cratering.

These media giants are scrambling to catch up with the market-shaking rise of Netflix

“Debt is unforgiving — it always has to be repaid or refinanced,” says financial journalist William D. Cohan, who has been sounding the alarm about rising corporate debt rates. “Debt has been very trendy for the last decade because the [Federal Reserve] has intentionally lowered interest rates. The trend has been to do big deals and finance them in debt markets. But when you pile on operational risk, integration risk and financial risk all together, that is a very dangerous stew.”

This is where the Hollywood SPAC takes center stage with the intention to acquire one of the major studios. These studios with a vast library of iconic content, infrastructure and legacy who are discreetly seeking or at the minimum are open for a sale might have no other choice to cover their debts are ripe for the Hollywood SPAC to swoop in and usher in a new era.

The Hollywood SPAC could certainly be a welcome relief for the targeted studios who have turned into their own villains overtime.